DEVELOPMENTS

Blended Finance Tools Offer a New Approach to an Old Problem

Jan 17, 2020

If the world were represented by 10 people in a room, seven would be of working age and six would have jobs. In Palestine, six people would be of working age and only three would have jobs. If the room were only women and girls in Palestine, only one woman in the room would have a job outside the home.

Decent work is one of the Sustainable Development Goals because of its importance for sustainable and equitable growth, providing a broad spectrum of benefits to individuals, families, communities, and economies. For the private sector, more and better paying jobs means more consumers and increased sales, leading firms to hire more people. For governments, it means more people paying taxes and fewer receiving benefits. As noted in The Economist, studies show more jobs also means less violence and crime in societies, and that “having a job gives people a sense of purpose which is also good for all sorts of social outcomes, including mental and physical health.”

Jobs are particularly important in fragile and conflict-affected states, such as Palestine, or states that have a history of chronic violence, because employment opportunities help create greater social cohesion and stability; more people have a stake in a stable today and can focus their energies on building a better tomorrow.

In partnership with the Palestinian Ministry of Finance, DAI was brought in in 2016 to test three approaches to using finance for private sector job creation in the midst of conflict. Since it began, the DAI-led Finance for Jobs (F4J) project, funded by the World Bank, has created about 100 jobs and mobilized $8.3 million in financing for small- and medium-sized enterprise (SME) investment while finding innovative ways to fund job creation.

Palestine’s Job Challenge

In some ways, the challenges facing Palestinians in their quest for decent work mirror those found in many developing and emerging markets. Palestine has a small population and a small private sector, a shrinking public sector under fiscal pressure, and a high dependence on entrepreneurship for employment.

Palestine also faces some unique challenges resulting from its tense and dependent relationship with Israel. Palestinians experience daily economic disruptions and mini-shocks due to restrictions on imports and exports, border closures, and the destruction of infrastructure linked to the conflict. And while employment in Israel and Israeli settlements provides an important source of income, restrictions on movement and unrest can make such employment unreliable. Palestinians are also divided between two very different economies. In Gaza, 1.8 million Palestinians live under far greater restrictions and economic hardship and are three times more likely to be unemployed as their fellow Palestinians in the West Bank.

Decent work can be found working for the government, the private sector, or running your own business. While each has its merits and value to an economy, the private sector provides nine out of 10 jobs in developing economies and seven of those are provided by SMEs.

The public sector remains a lifeline for employment in Palestine, with around 21 percent of Palestinians employed in the public sector, rising to more than 50 percent in Gaza. But the Palestinian Authority faces significant fiscal constraints due to its dependence on foreign aid and an unreliable system of tax transfers through which Israel collects and transfers tax receipts to the Authority.

In a project survey done of private companies in Palestine, respondents highlighted the lack of access to financing, poor public infrastructure, and a lack of workers with the requisite skills as factors that limit the growth, increase the cost of operations, and decrease the competitiveness of Palestinian companies. The Palestinian Authority’s lack of control over trade borders and over its own finances has led to delays in the government paying its bills and vendors on time. Lastly, ongoing conflict and political risks increase the real and perceived risk to investors and financial institutions considering financing Palestinian companies.

In addition to investment constraints, job growth driven by entrepreneurs is limited by the high number of unprepared—and even unwilling—entrepreneurs. Of the 20 percent of working Palestinians who are self-employed, close to two-thirds are entrepreneurs out of necessity rather than by choice. The 2018 F4J survey showed that despite university degrees and capacity building efforts from support organizations, most Palestinian entrepreneurs lack the experience to manage a business and have limited skills to attract investors. On average, only 1 percent of entrepreneurial ideas are considered for seed funding. Even among IT and internet startups—the favorites of investment funds—a vast majority are rejected for financing because they fail to fulfill the product acceptance criteria (that is, to meet client demands). And investors have little appetite beyond tech startups, leaving a range of businesses engaged in the “real economy” unfunded.

Mobilizing Finance for Jobs

Under F4J, DAI is testing three approaches to financing employment, each of which addresses one or more of the challenges of employment in Palestine:

- Investment Co-Financing Facility for companies generating new jobs.

- Entrepreneurship Ecosystem Matching Grant to invest in startups.

- Development Impact Bond to finance training, job search, and placement services.

Each approach has clear objectives and expected outcomes against which can it be measured to determine how much it contributes to creating decent jobs in Palestine and at what cost.

1. Investment Co-Financing Facility

A key assumption behind the World Bank-funded F4J is that many projects in Palestine are commercially viable, but external risks make them too risky to finance. A second assumption is that many of these unfunded projects would likely generate significant social and economic benefits through the creation of formal jobs. DAI’s own assessments indicate that projects in sectors such as tourism, information and communication technology, agribusiness, renewable energy, and light manufacturing in the West Bank and Gaza are commercially viable but fail to move forward due to external factors and the risk premium required by investors.

The Investment Co-financing Facility addresses this market failure. Financiers of an investment project usually rely on its internal rate of return (IRR) as a measure of value creation. IRR calculates the rate of return from after-tax cash flows; that is, investment into the project and after-tax cash flows from the project. These cash flows are measured over time using a discount rate to determine if the project has a positive or negative net present value. While the discount rate should approximate the weighted average cost of capital of the funds used for the project, the rate has to match or exceed the minimum that an investor requires to invest in a project—known as a hurdle rate.

Not surprisingly, this hurdle rate is higher in more risky environments. But because it is an “internal rate,” this calculation does not include any additional benefits or costs that might result from the project, particularly benefits to those who are not investors. Such benefits could include a new road that facilitates commerce or a water treatment facility that reduces the incidence of waterborne illnesses.

The Investment Co-financing Facility proceeds on the premise that investments that have a positive commercial return and/or provide a significant economic and social benefit (namely, jobs), merit subsidized investment—even when the projected returns are too low to attract investors. On this basis, F4J is testing grants for co-financing such projects. The challenge for DAI was to create a model that reasonably determines if proposed projects have a high enough commercial, economic, and social return to justify a subsidy.

With the Ministry of Finance and Planning, DAI and the World Bank team developed a socioeconomic cost-benefit analysis framework to apply to potential investments. The model quantifies the full economic rate of return and the socioeconomic rate of return. It considers the economic and social benefits including net increase (or decrease) in the number of direct and indirect jobs created as a result of the project, taxes collected (and paid) by businesses and their workers, as well the financial impact of a lower unemployment rate. The model can be adapted to consider other key economic or social benefits, such as lower environmental impact or better health or education outcomes.

Currently, five investment proposals have been assessed and approved by the World Bank to receive grant support through this facility. Those projects are expected to create approximately 2,200 jobs and mobilize private capital of $55 million. The first investment, concluded in 2019, was a photovoltaic solar energy roof at the Gaza Industrial Estate (GIE) (See “Blended Finance Case Study: Gaza Industrial Estate Solar Energy Rooftop”). The remaining four investments are solar roofs for schools, a seedless grape facility in the Jordan Valley, a chicken abattoir in Gaza, and a cement production process utilizing pyrolysis (thermal decomposition) of carbon and stone waste.

Entrepreneurs receive business development support. Photo: World Bank F4J.

2. Entrepreneurship Ecosystem Matching Grant

In most economies, SMEs drive job growth. For SMEs to grow, they need competitive products or services, smart business models, good management, and the right kind of capital at the right time. There are a handful of investment funds in Palestine, but they struggle to find SMEs strong enough to manage their investment. In fact, the number of investment funds has shrunk due to the lack of suitable SMEs. Potential investors in Palestine bemoan the poor quality investment pipelines generated by incubators and accelerators.

The Entrepreneurship Ecosystem Matching Grant is a cost-sharing mechanism that supports business development services for early-stage companies. It was initially designed to work through investment funds to select early-stage companies in a way that investors could decide the skills needed for the SMEs to access or better utilize capital. In June 2017, F4J signed its first grant agreement with Ibtikar Fund, a dominant early-stage investor in Palestine, to grow a portfolio of investable projects. The matching grant provided a 70 percent reimbursement to Ibtikar for the services that it contracts to support current and potential investees. In this first round, Ibtikar provided services to seven business which are now part of its portfolio. The startups range from SocialDice, an online recruitment system that matches CVs with jobs posted by companies on its site, to Mashvisor, a Ramallah-based company that launched a U.S.-focused real estate site that allows potential investors in residential properties to quickly determine what kind of returns a property will provide.

Given the limited number of investment funds in Palestine, F4J has broadened its matching grant partnerships beyond investors to entrepreneurship development programs that are already addressing market gaps and providing business development support at various levels. In 2019, F4J began partnering with the Leaders Organization, a provider of business incubation, management consulting, financial management support, legal advice, marketing, and business development services. Its network reaches pre-investment-phase startups to make them better candidates for investors like Ibtikar.

As of June 2019, 13 of the companies that benefited under the matching grant had mobilized funds—nearing $3 million. F4J calculates that some 80 new jobs were created as a result. F4J anticipates that the next wave of firms under the matching grant beneficiaries will collectively raise another $3 million by 2021.

3. Development Impact Bond: Skills Development

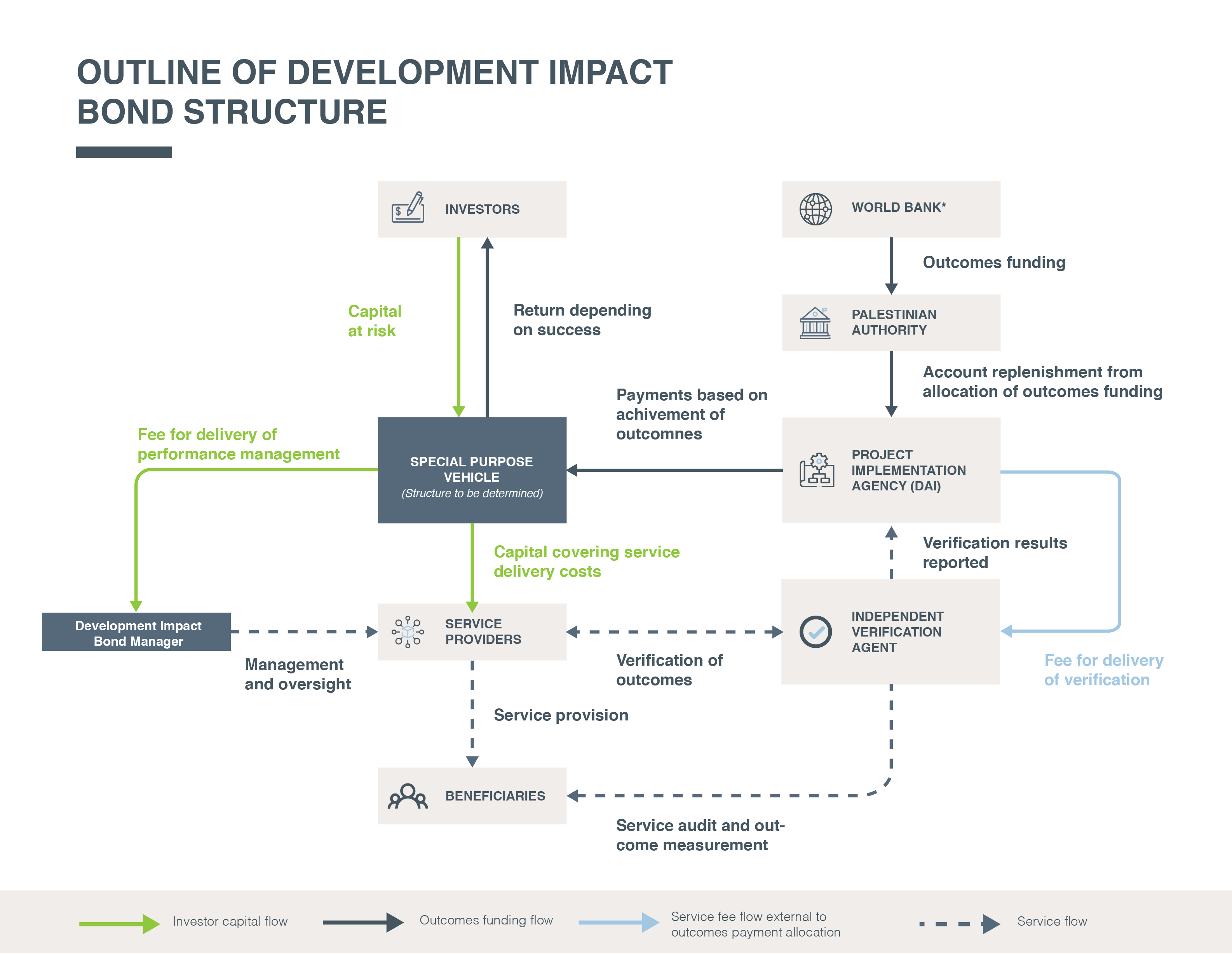

In late 2019, F4J launched a $5 million Development Impact Bond in Palestine—the first in Palestine, the first by a World Bank programme, and the first in a fragile state. The proceeds of the bond will provide training and other services to approximately 1,500 Palestinians ages 18–29, including at least 30 percent women. Specifically, it will finance training, job search, and placement services to job seekers through a process designed to match the current demand for skills in the private sector.

Development impact bonds are a relatively new mechanism in results-based financing for development. They are contracts in which one or more private investors provide working capital for social programs, implemented by service providers (such as nongovernmental groups, lenders, business development service firms, or others) based on a promise of repayment from one or more “outcome funders” (government, public sector agencies, donors, and so on)—but only if they achieve the desired results. The bonds help crowd in some private financing, albeit temporarily in most cases, and outsource the performance risk to those same financiers.

An initial commitment of private capital in the amount of $1.8 million was secured from the Palestine Investment Fund, the European Bank for Reconstruction and Development, the Netherlands Development Finance Company, and Invest Palestine through the Chilean-Palestinian Diaspora Investment Fund, “Semilla de Olivo.” The World Bank West Bank and Gaza Trust Fund has committed up to $5 million as the outcome funder, to be paid through the Ministry of Finance upon the successful completion of the project. For accepting the performance risk, these funders could receive up to a 15 percent return if the desired outcomes are 100 percent achieved. However, the expected return is between 5 and 15 percent, given the difficulty of fully implementing the project.

Monitoring and evaluation of the bond implementation is critical and will fall to the F4J project. Specific outputs and outcomes that will be measured include the number of beneficiaries that complete training, their placement into an apprenticeship/internship/work-based training scheme, and their ultimate employment. The bond, launched in November 2019, took two years to design with the technical support of Social Finance UK.

By testing out different blended approaches to job creation, F4J is setting the stage for the next generation of larger investments by the World Bank and others. F4J will continue to adapt, test, and iterate different approaches, and track the results of each so that the broader development finance community can be part of the learning on how to do innovative finance in conflict-affected states.

Mazan Asad is F4J’s Project Manager and Till Bruett is DAI’s Global Practice Leader in Financial Services and Investment.