DEVELOPMENTS

Unlocking Capital: How USAID Pushed the Frontier of Financial Services and Built a Foundation for Economic Growth in Kenya

Mar 27, 2017

In 2010, as part of the U.S. Government’s Feed the Future initiative, the U.S. Agency for International Development (USAID) designed the Kenya Financial Inclusion for Rural Microenterprises (FIRM) project. FIRM aimed to push the frontier of financial services into the agricultural sector where smallholder farmers—the bulk of Kenya’s 45 million people—were mired in poverty.

December 2016 saw the closedown of FIRM. Between 2011 and 2016, FIRM facilitated more than $1 billion in financing, benefitting 2.5 million local and mostly farm-based households. By itself this marks a great achievement, as does the resulting financial inclusion, resilience, and food security for Kenyans. But it tells only part of the FIRM story.

Adapting and Contributing to USAID Priorities

As its name suggests, FIRM was designed with a core mission to expand financial inclusion for rural microenterprises. But as the program evolved, FIRM’s team and sub-partners—consisting almost entirely of Kenyan nationals—built up a deep and diverse roster of financial and nonfinancial services professionals and institutions. And that team is now prepared to help serve the country’s finance and investment needs, and drive local and regional integration and development investment, in areas ranging from agriculture and energy to water, sanitation, and hygiene (WASH).

FIRM came of age during a dynamic period in Kenya’s political and economic history—a period that marked significant economic growth opportunities as well as the uncertainty surrounding a devolving government in a tumultuous region. FIRM also adapted and bridged to USAID/Kenya’s emerging priorities under Feed the Future, Power Africa, and programming in WASH.

Feed the Future: FIRM began as Feed the Future was launching and was retroactively incorporated into its framework, leveraging DAI’s experience and reputation in the financial services sector. The FIRM team opened its doors to—and knocked on the doors of—any and all traditional and nontraditional financial and nonfinancial sector actors. Of those potential partners, FIRM had one requirement: be willing to push the frontier of financial services into agriculture for smallholders in underserved and never-served rural areas. From there, FIRM improved the availability and suitability of financial products by consulting a broad range of partners and customizing agriculture strategies where none previously existed:

- Extending branch locations outward from Nairobi, Mombasa, Kisumu, and other urban centers.

- Identifying and training new employees for financial institutions.

- Designing, piloting, and bringing to scale customized products and services for specific commodities in new geographies, in some cases with the backing of Development Credit Authority (DCA) guarantees.

- Introducing new policies, procedures, and technology to push the expansion of new financial systems.

Put simply, FIRM changed the financial services’ landscape throughout Kenya for smallholder farmers and agricultural micro, small, and medium-sized enterprises.

Power Africa: In 2013, USAID launched its Power Africa initiative to bring electricity to the two-thirds of people living in Sub-Saharan Africa without power. FIRM assisted seven partner financial institutions under the DCA to develop energy finance strategies and loan products. FIRM and its partners also built a portfolio of five clean/renewable energy financing proposals—four hydro and one biomass—totaling $42 million. The first transaction for $7 million—$2 million equity and $5 million debt—closed in December 2016 for a hydropower plant in Nandi county on the Yala River.

WASH: With WASH reemphasized in the U.S. Government’s Global Food Security Act of 2016, FIRM developed related loan products for three of its DCA partner financial institutions so that the banks could lend, for the first time ever in Kenya, to public utilities and community-based organizations. The single largest loan made to a water utility was guaranteed by USAID with FIRM’s technical assistance—to Meru Water and Sewerage Services in Meru County. In addition, FIRM identified investment-grade WASH opportunities in each of the five counties for which it prepared County Investment Plans.

Ag, Energy, and WASH: A Fruitful Nexus

While FIRM supported distinct USAID priorities, it also highlighted their interconnected nature:

- Agriculture production leaves behind organic waste such as manure that can be converted into clean energy for cooking and lighting.

- Lighting allows children to study at night, increasing their future earning potential and economic options.

- Access to a dependable and clean water source improves family health and boosts agriculture production, thereby expanding household incomes.

This self-enforcing cycle of positive outcomes requires just one loan to jumpstart a process that human ingenuity and drive then takes over.

For example, a USAID-guaranteed DCA loan of approximately $1 million to the Embu Water and Sewerage Company was provided by FIRM partner Housing Finance Group. As a result, in rural areas where small farms were connected for the first time to a safe and reliable water source, FIRM’s partner MFIs experienced significant spikes in demand for dairy loans. BIMAS, an Embu-based microfinance institution, reported increased loan requests for both dairy cows and water storage and irrigation equipment.

Expanding Finance and Investment Vehicles

In providing consulting support to more than 100 financial institutions and related actors, FIRM used a “portfolio approach”—making many small bets across a wide range of partners. This technical assistance complemented by DCA risk-mitigation tools enabled a diverse pool of institutions—large, medium, and small commercial banks; microfinance banks; nongovernmental microfinance institutions; and Savings and Credit Cooperative Organizations—to improve their performance, and FIRM provided additional support to those showing the clearest evidence of sustained growth and impact.

FIRM worked with industry associations and supported numerous national regulators with technical assistance, building a financial services ecosystem more conducive to economic growth. For instance, the FIRM team supported an initiative by the Kenyan Retirement Benefits Authority to enable pension funds to invest up to 10 percent of their holdings in private equity, which represented a new asset class for Kenyan pension funds. Working with USAID’s Private Capital for Africa Group, FIRM convened the Kenya Capital Markets Authority (CMA), Kenya Fund Managers Association, and top pension funds to deliberate the decision. In June 2016, National Treasury Cabinet Secretary Henry Rotich formally announced the initiative, enabling pension funds to invest 10 percent of their assets—about $500 million—into private equity and CMA-licensed venture capital funds. For Kenya, this change is expected to stimulate private investment by domestic and international sources in the country’s most pressing development initiatives.

Building County-Level Investment Pipelines and Readiness

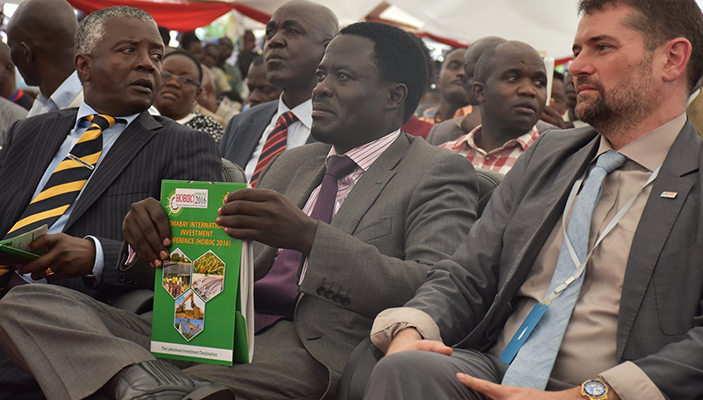

When Kenya’s constitution passed in 2010, it called for establishing 47 county governments to bring public services and investments closer to the people. In 2014, USAID tasked FIRM with promoting local investments by working with newly formed county governments and Kenya’s Council of Governors. FIRM first helped five counties turn their County Integrated Development Plans into investment strategies, portfolios, and priorities. For some, FIRM developed energy asset maps and agriculture asset maps to add more detail for potential investors. The five counties identified more than $1 billion in investment-grade opportunities. Ultimately, each county won commitments from investors, worth a collective $100 million for projects in potato and fish processing, small-scale and bulk water, and irrigation.

In Taita Taveta county, for example, FIRM helped develop and market long- and short-term public investment opportunities. Governor John Mruttu singled out repair to dilapidated water infrastructure because of its importance to developing horticulture, dairy, livestock, and biogas. In July 2016, Taita Taveta launched its first water investment strategy, drawing parties from national and local government—including Kenya’s Water Services Trust Fund—and from more than 40 foreign missions. Commercial bankers and business investors also attended. The launch spurred KES600 million (US$6 million) in pledged investments from the private sector to help finance construction, notable considering the county’s new relationship with the private sector. FIRM expects the first water sector investment plan will be financed with a mix of debt, equity, and grants.

Investing in Kenyan Solutions, Innovation

In line with Feed the Future goals of seeing smallholders benefit from new technologies, FIRM met with hundreds of potential investees and made small consulting or technical assistance bets on promising opportunities and innovations. Not all had rich paydays, but those that did created dynamic growth industries and life-changing grassroots opportunities.

For example, when FIRM met iCow, an innovative mobile extension service provider for dairy farmers, the information technology company had 3,000 smallholders on its platform. FIRM hired one of its preferred Kenyan consultants to support the fledgling company and source gratis long-term consulting from Accenture. FIRM’s consultant also facilitated grant funding for business growth from Elea Foundation.

As iCow prudently expanded, FIRM’s consultant brokered iCow’s transition to Safaricom’s platform, facilitating the company’s explosive growth. It now serves more than 1.5 million farmers.

Kenya’s Financial Services Ecosystem—Moving Foward

Strategically located along the Indian Ocean next to emerging countries such as Ethiopia as well as volatile but hopeful Somalia, Kenya’s complexity provides opportunity for both great opportunity and instability. While the capital of Nairobi and seaport of Mombassa drive the fifth-largest economy in Sub-Saharan Africa, most of Kenya’s people live hand to mouth across the country’s largely ungoverned savannah and desert. Now, millions have benefitted as the country’s financial infrastructure becomes increasingly accessible, user friendly, and inclusive thanks to the FIRM team and others.

FIRM’s most enduring achievement might be its conscious strategy to draw on and support Kenyan experts and professional services firms. In 2011, USAID Forward committed USAID to promote sustainable development through high-impact partnerships and local solutions. FIRM embraced the initiative. Nearly all of FIRM’s staff were local nationals and its four subcontractor partners were Nairobi-based: J.M. Mantle and Co., Big Five Africa Ltd., Open Capital Advisors, and Viability Africa LLC.

“FIRM is very different from other financial services development partners in its strategy to engage local professionals and service providers,” said Michael Mithika of J.M. Mantle.

Kenya is the largest economy in—and the growth engine for—East and Central Africa, and has its most developed financial industries. The country’s forward-thinking Central Bank has an opportunistic and entrepreneurial approach to regulatory reform, balancing stability, efficiency, and inclusion while encouraging financial sector innovation. Its financial services industry represents a diverse set of increasingly competitive institutions focused on the base of the pyramid. Kenya is also a world-class leader and trendsetter in mobile technology, payments, and transfers.

Kenya is ready to step up to the next level of financial services provision and capital mobilization for key sectors and, in turn, deliver increased stability and opportunity for its citizens and the region. Especially promising are investment and financing opportunities in USAID-priority areas of food security, energy, and WASH, for which FIRM has built a solid foundation of professionals and institutions who will continue to serve the market for years to come.