DEVELOPING ALTERNATIVES

The Climate-Resilient City

Sep 29, 2014

Using public-private partnerships (PPPs) to develop infrastructure that will enhance urban resilience to climate change is a promising option for countries affected by increasingly intense droughts, severe floods, and other environmental factors. Countries such as Mozambique and Vietnam are now piloting aspects of this approach, but we must address various weaknesses in it if we are to come up with a “climate-smart PPP” program.

Vietnam is a useful case study. Three development issues are shaping how Vietnam addresses urban resilience to climate change. First, large-scale migration is increasing the number of urban centers that lack critical infrastructure such as water, sanitation, solid waste, transport, and energy. Second, the effects of climate change on economic growth have introduced new risks in urban infrastructure planning and investment. Third, the shrinking fiscal space and the need for greater infrastructure investment is reinvigorating alternative forms of investment (such as PPPs). Within this context, we see an opportunity to use PPPs to upgrade infrastructure while strengthening urban resilience to climate change.

Urban Migration And Climate Challenges

Climate change is a pressing development challenge for Vietnam. The United Nations (UN) estimates that 54 percent of Asian and Pacific urban populations live in low-lying coastal zones. Cities such as Ho Chi Minh City and Hanoi are highly vulnerable to sea level rises, stormwater surges, and flooding. They also face climate change-related consequences in rural areas (floods, droughts, and loss of crops and productivity), which become “push” factors in rural-to-urban migration. As stated in the UN report, “although the poor contribute the least to climate change, they can be expected to suffer the most from the negative impacts, whether they live in urban or rural areas”1.

Vietnam’s Ministry of Construction—the government body playing the lead role in urban development—estimates that by 2015, the country’s urban population will reach 35 million (almost 40 percent of the total); by 2025, the urban ratio will reach approximately 50 percent and there will be nearly 1,000 urban centers. According to the World Bank, approximately 70 percent of Vietnam’s gross domestic product is generated in urban centers2. This concentration of economic production and the increasing rural-to-urban migration amplify the potential consequences of climate change, particularly in highly vulnerable centers such as Ho Chi Minh City, Hai Phong, Hanoi, and Nha Trang. The potential losses are enormous. The World Bank estimates that climate-induced disasters between 2010 and 2050 could cost up to $49.5 billion in Ho Chi Minh City alone3.

The Research Gap

Research on PPPs in the context of infrastructure development and climate change is still in the nascent stages. While PPPs in renewable energy have been a principal focus of climate mitigation strategies, the focus has been on PPP development rather than on applying a climate change lens to PPP projects. Aldo Baietti and his colleagues have taken a thorough look at the various risks and challenges involved in financing green investments4. They have also developed a useful framework for how “green infrastructure finance” can be implemented effectively. Tyler and Moench (2012) explore how cities should approach climate change by proposing a framework that recognizes infrastructure as part of a broader set of systems, agents, and institutions necessary for urban climate resilience5. The World Bank’s report on Asian global megacities emphasizes the value of combining infrastructure-based solutions with ecosystem-based adaptation measures in combatting climate change.

Still needed, however, is close analysis of the policy-level actions required to stimulate an explicit connection between PPPs and climate change, as well as methodologies and tools for how to operationalize this concept in project planning, design, and implementation.

Urban Resilience Through Climate-Smart PPPs

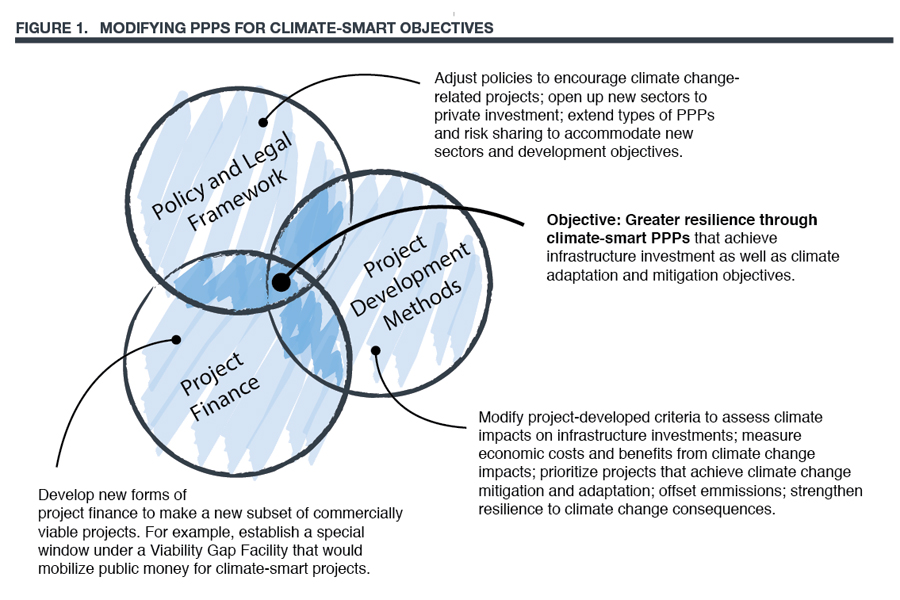

The climate-smart PPP approach to infrastructure development modifies existing private sector initiatives by adding a climate change lens. As shown in Figure 1, three core elements of any strong PPP program—the policy and institutional framework, project development methods, and project finance—must be adjusted to reflect climate change and resilience objectives.

For Vietnam, a climate-smart PPP approach is well placed to grow out of the government’s ongoing reform of its PPP program, an initiative that benefits from strong political leadership. Following are recommendations, in the three core components of PPP work, on how Vietnam can adjust its program to accommodate the climate-resilience agenda. Each recommendation, while specific to Vietnam, is applicable to other countries given appropriate modification for context.

The Policy And Instituitonal Framework

This framework must set forth the guiding principles and regulations that encourage the incorporation of climate change impact analysis and planning into project design and development. Among the principles we recommend:

- Integrate ecosystem-based adaptation, carbon emissions reduction, and energy efficiency elements into PPP policy objectives. This commitment would mean assessing each investment under consideration for ways to strengthen associated ecosystem-related activities: freshwater storage, erosion and flood control, and water purification; adaptive measures such as reforestation and restoration of wetlands, mangroves, and natural flood zones; rehabilitation of canals and rivers; strengthening of zoning regulations to enhance ecosystem resilience; planting of buffer zones along dikes and riverbanks; and the establishment of flood control systems.

- Tie infrastructure development into Resilience Action Plans. Certain policy adjustments must also be taken. For example, infrastructure development should be tied into Vietnam’s Local Resilience Action Plans (LRAPs) for Hanoi, Can Tho, and Dong Hoi. The LRAP is the planning document and analytical tool for a city to improve its resilience. By synchronizing climate change planning with the PPP infrastructure agenda through the LRAP process, Vietnam can bring the infrastructure and climate change agendas together.

Project Development Methods

Project developers must factor in the social impacts and benefits of climate-resilient designs and energy efficiencies as they identify, structure, and analyze each project, financially and otherwise. Such integrated analysis should inform the policy framework for selecting and prioritizing PPP projects for implementation. Among the steps we recommend:

- Strengthen government capacity in project design and development. Vietnam’s capacity to design and implement investment projects remains limited, which drives up both the cost and the time for completing projects and reaching development objectives. Dedicated PPP units have been shown to enhance the value of a PPP by 10 to 20 percent6. The next step is to equip the dedicated PPP unit with the skills to manage PPP project development and apply criteria that guide investments toward economic and social development objectives—one of which could be climate change-related. Examples include assessing a project’s impact on greenhouse gas emissions or the resilience benefits of relocating facilities to less vulnerable areas.

- Build in climate change measures as criteria for accessing resources from the Project Development Facility. Vietnam’s Ministry of Planning and Investment is setting up a Project Development Facility (PDF) to provide funding and technical support to encourage the development of projects that address specific constraints. PDF funding and technical assistance should be targeted at climate-smart PPP projects. For example, the PDF could select a small group of pilot projects and, from these, develop project screening criteria and risk identification frameworks for climate-smart PPP projects more generally. Using actual pilot projects and data rather than theoretical models to construct these frameworks will mitigate the tendency to overlook real-world, market-specific factors.

- Introduce new performance measures for infrastructure service delivery. Incentives built into PPP contracts could be adjusted to incorporate low-carbon principles. These might include performance indicators linked to emissions or energy consumption. Certain performance measures could even become saleable certified emission reduction credits, earned by designing climate-smart infrastructure, which investors might find attractive. Applying such indicators would bring more transparency to the selection and measurement of infrastructure investments, enhance commercial viability in the eyes of the private sector, and promote the collection of useful data for tracking carbon emissions from a particular municipality or infrastructure asset.

Project Finance

Creative project finance mechanisms will be needed to address the unique risks associated with these types of PPPs.

- Develop a financing framework for climate-smart infrastructure and PPPs. Deepening domestic long-term access to infrastructure financing for those PPPs with climate change dimensions is critical to addressing the infrastructure deficit and attracting private investment. Accessing green infrastructure finance requires understanding the distinct risks associated with green infrastructure, such as higher up-front capital costs, the risks of novel technology, and public policy distortions (such as Vietnam’s coal export restrictions, which complicate the competitive pricing of renewable energy). Developing a framework for assessing and valuing these risks—a combination of policies, regulations, and incentives that encourage investment in the right direction—would enable Vietnam to drive adaptation and mitigation activities that together contribute to lower carbon emissions (through renewable energies and improved energy efficiency), better preparedness (through risk analysis and mitigation strategies), more secure natural resources (through reforestation, watershed management, and water security), and improved urban infrastructure generally.

- Establish dedicated green infrastructure guarantee facilities. Existing mechanisms such as the Local Development Investment Funds are limited in size and scope, and the local bond markets are not sufficiently developed to meet PPP financing needs. There is also little experience among banks in investing in climate-related infrastructure via PPPs. And the risks associated with climate-smart projects—whether related to technology or to valuing carbon—are not fully understood. Potential investors in this sector have indicated in interviews with DAI that dedicated guarantee facilities targeting specific investments with climate change-related objectives would be particularly useful in reducing the risk of investing in these projects.

- Promote climate change-related investments through the Viability Gap Fund. Public funds can also be useful in stimulating investment in this sector. The Government of Vietnam is moving forward with a Viability Gap Fund (VGF) that will make available public resources for well-structured PPP projects that still require public contributions to be commercially viable. The VGF can build in selection criteria that favor projects that address high-priority infrastructure and climate change needs. Modifying the VGF to support noncommercially viable, ecosystem-based adaptive measures could transform a traditional PPP into a climate-smart PPP.

Takeaways

- Burgeoning cities put enormous pressure on urban infrastructure, which is only exacerbated by the effects of climate change.

- In a fiscally constrained environment, public-private partnerships are an increasingly attractive vehicle for infrastructure investment.

- We have an opportunity to incorporate climate change and urban resilience perspectives into the PPP process, focusing on the policy framework, project methods, and project finance.

Footnotes

-

Vietnam Ministry of Construction. 2006. Urban Development Strategy. Hanoi: Socialist Republic of Vietnam. ↩

-

World Bank. 2006. Vietnam’s Infrastructure Challenge. Washington, D.C: World Bank. ↩

-

World Bank. 2010. Climate Risk and Adaptation in Asian Coastal Megacities: A Synthesis Report. Washington, D.C.: World Bank. ↩

-

Baietti, Aldo, Andrey Shlyakhtenko, Roberto La Rocca, and Urvaksh D. Patel. 2012. Green Infrastructure Finance: Leading Initiatives and Research. Washington, D.C.: World Bank. ↩

-

Tyler, Stephen, and Marcus Moench. 2012. “A Framework for Urban Climate Resilience.” Climate and Development. No. 4: 311–26. ↩

-

McKinsey Global Institute. 2012. Vietnam’s Growth: The Productivity Challenge. February. ↩