Market Systems Development: A Primer on Pro-Poor Programming

Jul 13, 2015

Ending extreme poverty. The goal could hardly be more ambitious—or more challenging. International donors have rallied around it, and are united in their belief that broad-based economic growth is essential to achieving their vision. The key, though, is that term “broad-based.” How do we ensure that economic growth programming is benefitting the very poor? And at a scale that really makes a difference? Increasingly, the answer lies in an approach called market systems development.

Donors such as the U.S. Agency for International Development (USAID), the U.K. Department for International Development (DFID), and the Swiss Agency for Development and Cooperation (SDC) have endorsed market systems development as an effective way to enable large numbers of poor people to achieve sustainable increases in income. In 2013, they signed a memorandum of understanding to formalize their agreement and commit to collaborate on research and learning.

This paper provides a brief overview of market systems development, some of the key considerations in implementing good market systems development programs, and examples of interventions that have led to more effective market systems. As the overall approach is still relatively new, there are few examples that show the full impact of the work—to gauge the true impact of an intervention, get a clear sense of the “crowding in” it has been able to catalyze, and assess its likely sustainability, we must continue to measure well after the project itself has ended. That said, the interventions under way provide practical examples of where and how the market systems development approach is working.

Two Methodologies Come Together

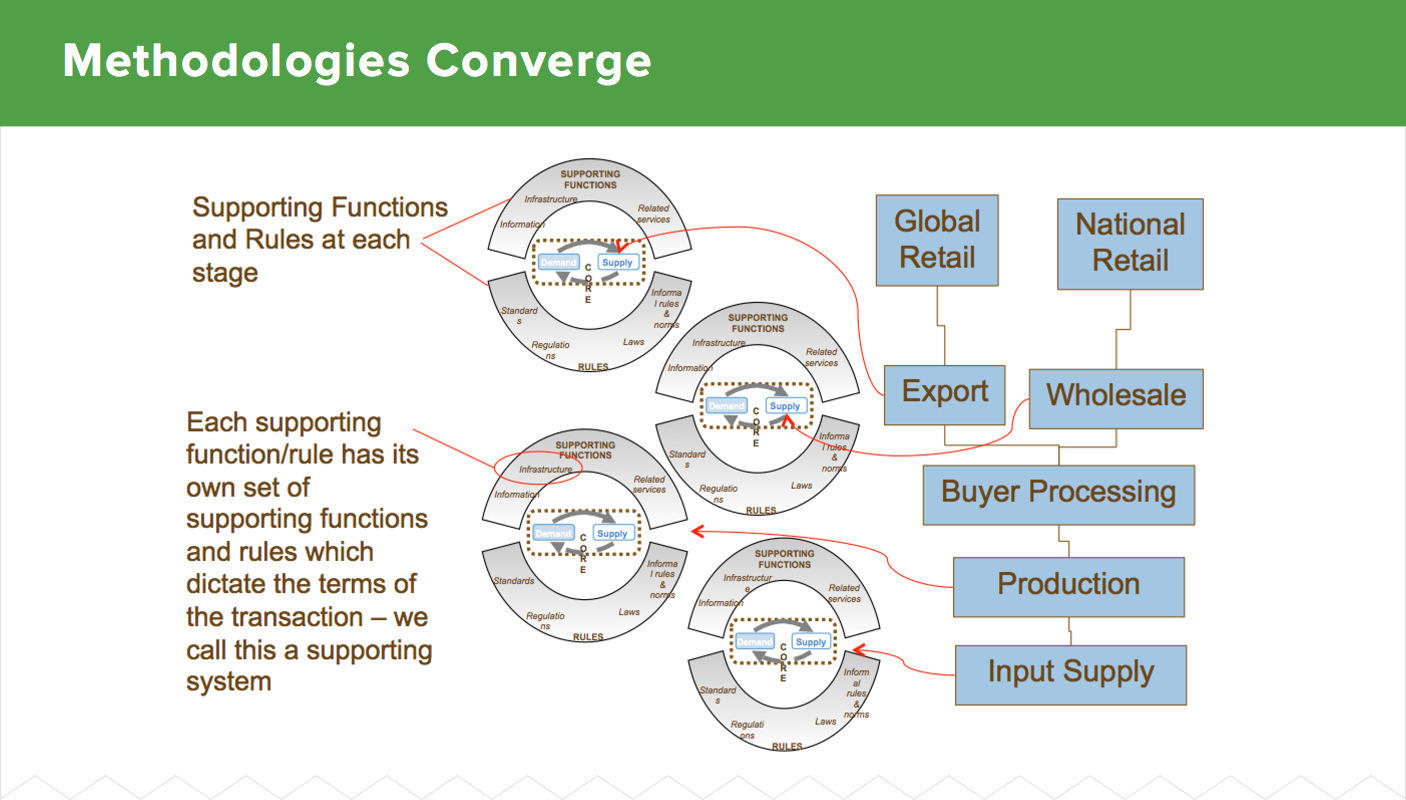

DAI has been one of the leading exponents of market systems development programming, implementing numerous economic growth projects for USAID, DFID, and SDC, and contributing to the research base on the subject. In the past 10 to 15 years, two complementary strains of market systems development thinking—born in the “subsector” analysis of the early 1990s—have come together: USAID’s value chain approach and DFID’s market development approach (also known as Making Markets Work for the Poor, or M4P). The former is based largely on Michael Porter’s work on value chain analysis, the latter on Douglas North’s institutional economics.

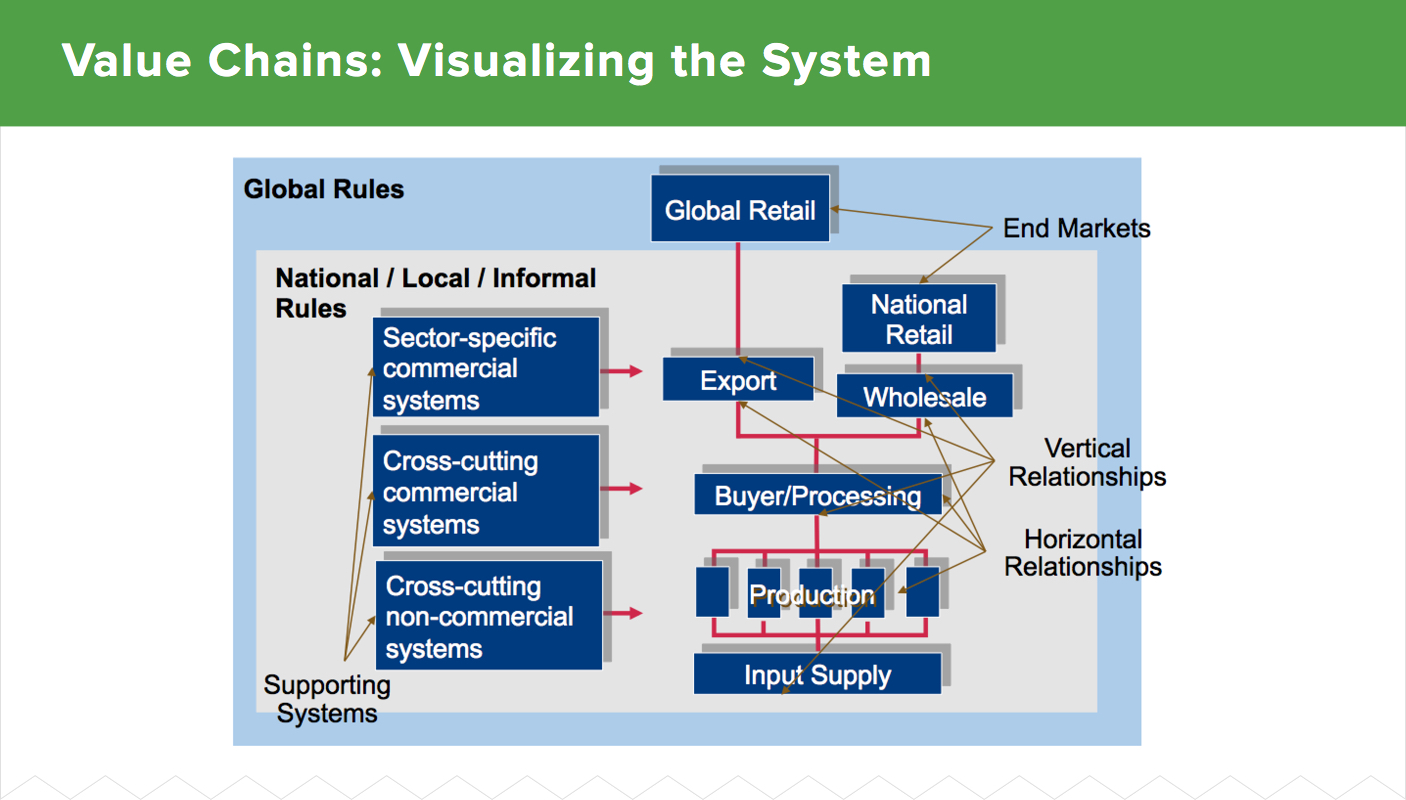

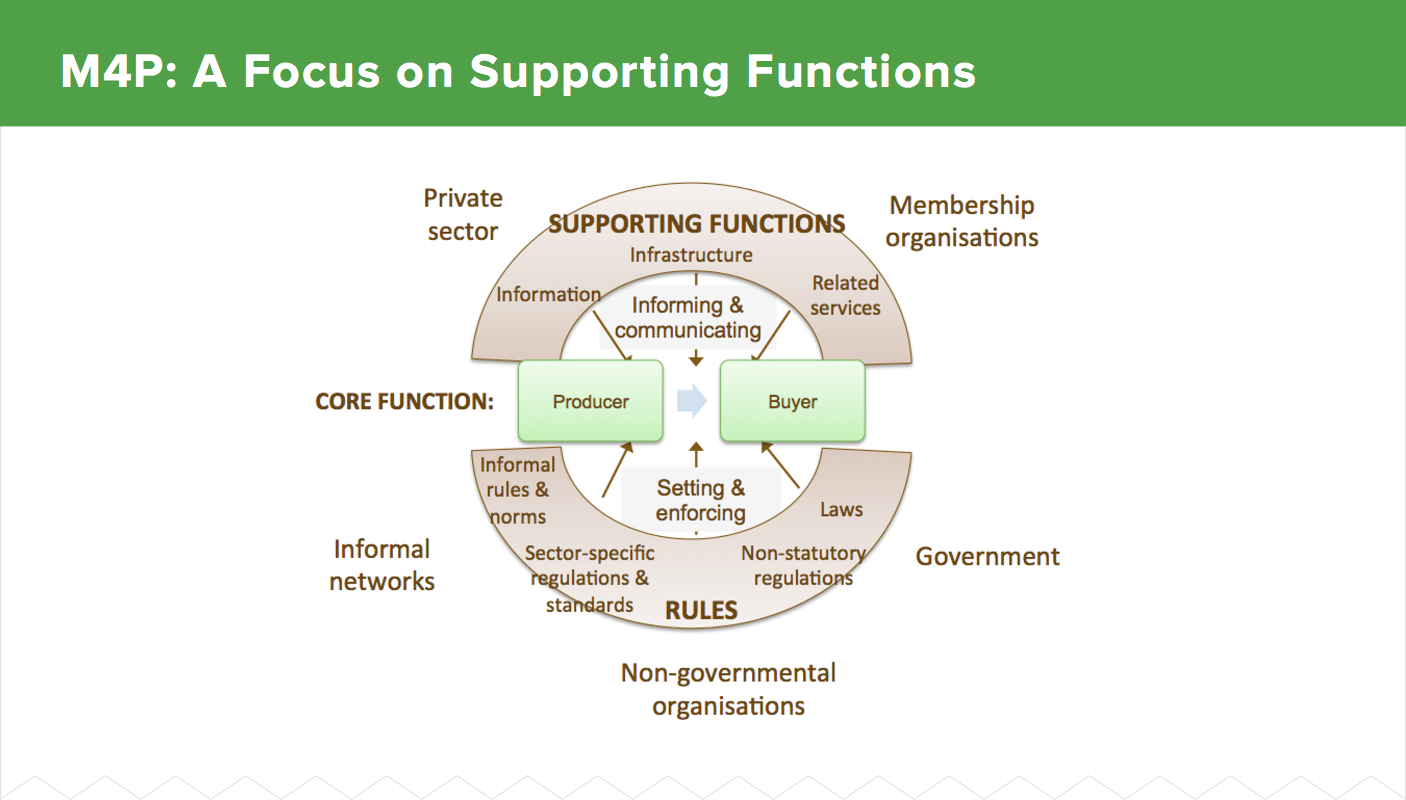

While there are some differences between the two, both take what can broadly be termed a “systems” approach and address the same underlying system components:

- the core transactions and relationships between buyers and sellers of the product or service in the value chain;

- the rules affecting the system, meaning the political, economic, and social values or customs, which may be codified as norms and practices either formally or informally; and

- the supporting functions or systems, meaning the commercial and non-commercial services essential to the functioning of the core market system, but not directly part of it.

Each approach has its strengths, but the development practitioner’s art lies in appropriately blending the two to achieve a given objective in a given context.

The value chain approach provides an excellent model for visualizing the structure of the overall sector, seeing where the poor are physically located in it, and identifying the functions they perform and the actors with whom they engage. It provides a level of granularity and disaggregation critical to understanding the role of the poor in the broader market system; facilitates analysis of the trends in a sector—how it is growing, which channels are thriving, which are failing—as well as a clearer understanding of the end markets; and illuminates how the dynamics of the sector will affect the poor, and how they will need to upgrade their services to remain competitive.

The M4P model, on the other hand, is strong on the diagnosis of the system around a specific transaction, say between an input supplier and a producer, or between a producer and a processor. This framework helps pick apart the transaction and clarify the underlying causes of market failures, thereby informing interventions to address them.

Bringing the two approaches together yields both a broader understanding of the sector—leading to a clearer sectoral strategy—and a detailed diagnosis of the key transactions constraining the economic welfare of poor people in the sector.

From Theory to Implementation

To implement these approaches well, we must start with a firm grasp of what we want to achieve by the end of the process: a smoothly functioning, sustainable system that drives increasing productivity and competitiveness for the benefit of poor people. The following sections lay out the key drivers of sustainable, inclusive growth at the sector level, and the steps we should take as implementers—or, more precisely, as market system facilitators—to set these drivers in motion.

Understanding the drivers of growth at the sector level

A sector grows when the whole sector is more competitive and able to effectively serve growing end markets. Increased competitiveness requires changes in the knowledge, attitudes, and practices of the various market actors to increase productivity and derive better and more efficient horizontal and vertical relationships. Ultimately, achieving inclusive economic growth depends on stimulating behavior change among the actors in the market systems. Good changes in behavior will lead to steady upgrading of practices and relationships, where people are continually and sustainably increasing their individual productivity, but also making the entire sector more efficient and competitive.

The market actors in a sector relate to each other in various ways: they both compete and coordinate. In an efficient value chain, one that is constantly enhancing its competitiveness, the relationships between actors are characterized by good competition and effective coordination, which ultimately establish mutual benefits for all the actors in the sector. Good market systems development projects stimulate such competition and coordination.

- Good competition tends to be between market actors at the same functional level in the sector. Competing to do better than the firm next door drives innovation and steady upgrading of productivity and capacity to outperform the competition, rather than undercut it. Sectors grow when competition is driving shared learning, new solutions, and pressure to innovate.

- Effective cooperation tends to be between mutually dependent firms at different functional levels of the value chain (who buy from or sell to one another). It is based on win-win strategies, not on the “win-lose” strategies too often seen in traditional market relationships, where one firm gains at the expense of the other. Good cooperation—transparent, long-term, trust-based, responsive to joint opportunities and threats—leads to more efficient value chains.

- Ultimately, sectors will grow most rapidly when all the market actors see mutual benefits from working well together.

When these three elements are in place—good competition, good cooperation, and broadly distributed mutual benefits—the sector is more likely to grow steadily and inclusively. Putting these elements in place starts with establishing a clear vision and strategy.

Establishing a clear vision and strategy

The best market system analysis identifies not just what the system looks like now, but what it could look like in the future. What types of competition would it foster? What are the desired relationships between the market actors? How would the sector need to change to bring about greater, more inclusive growth?

As we establish the strategy to achieve the vision, we must focus on the reasons why people have not yet changed their behavior. What is holding them back? What will they need to do to change? People’s decisions in the economic arena often turn on risk, and individuals’ appetite for riskier behavior. Our strategy must identify those individuals or firms more likely to embrace a higher risk profile and try things that might yield higher rewards. Generally speaking, once these individuals have taken up the new behavior, they will have lowered the risk profile and made it easier for others to follow, though the strategy will still need to contemplate how to address continued risks to market actors.

Designing the right intervention

The design of the intervention must be based on a clear understanding of the market failure we are seeking to address and its underlying causes. As a fundamental principle, both the value chain and M4P approaches rely on facilitation to ensure sustainable outcomes, where the project implementer does not deliver the results directly but adopts a hands-off approach and engages market actors themselves to address underlying issues. Many interventions start off as pilot activities, to prove the causal model, but are then taken to scale by crowding in other partners.

Assessing the market system and context

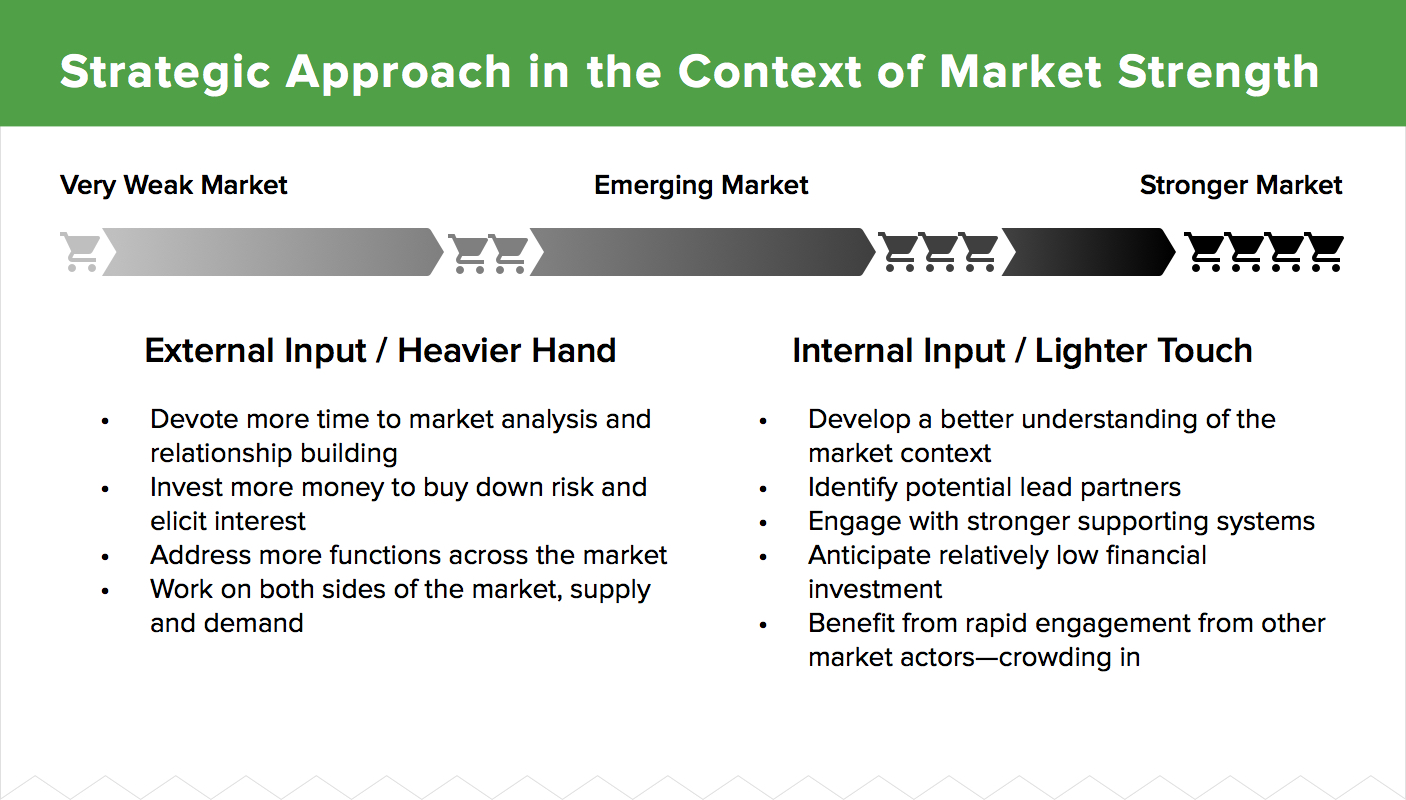

We must understand the market conditions if we are to work effectively. Weaker market systems will require more direct external input from the implementers (a heavier hand); stronger market systems might require only a light touch to facilitate productive relationships from inside the sector.

Key factors in the assessment of the market context include economic purchasing power, population density, political economy, the presence and dynamism of interconnected systems or service providers, the availability of strong lead firms, linkages to end markets, and the degree of social cohesion. The strategic approach will differ according to where the market lies along the continuum of weak to strong, as captured below.

DAI has developed various tools to expedite market assessment and intervention design. Each intervention includes a justification statement, for example, outlining the impact that could be achieved, the potential partners, and a results chain. Results chains provide a detailed, albeit relatively simple, at-a-glance visual summary of each market intervention, giving management, technical, and monitoring and evaluation teams a step-by-step depiction of the intervention’s underlying causal logic.

Selecting the right partners, agreeing the intervention

Since our objective as implementers is not to do the interventions directly, but to get local market actors to engage on their own behalf, we must determine which partners to work with during the pilot phase. One of the biggest risks to the facilitator is working with the wrong partners. Identifying the right type (profile) of firm is part of the overall strategy, but once we have the general profile, we must make sure that we start with the most appropriate firm or firms. These firms should be at the right point in the system to achieve leverage, so that significant change can be achieved, but they must also have the will and the capacity to deliver at scale.

One tool DAI uses to select partner firms is the “Will/Skill Matrix,” which helps us assess whether a company has the right combination of commitment to the exercise and technical mastery of the subject, as well as the managerial and financial capacity to deliver the necessary results. Once the partner is selected and its role in the program agreed, it is crucial to document the specific expectations of both sides, as well as the inputs each party will contribute. DAI’s “Deal Note” and “Workplan and Budget” tools concisely and explicitly document our expectations with the partner, establishing our mutual interests and expected results.

Planning for exit: crowding in other market actors

Projects need to plan their exit from day one. As the pilot phase matures and positive results become visible, we seek to crowd-in other market actors who will copy or compete with the lead firm, further expanding the system and enhancing its competitiveness. Crowding in those other actors may involve quantifying the benefits and making the value propositions public, so that firms can decide if they want to participate. Our strategy might include offering additional support, albeit at a lower level, to aspiring competitors. As we withdraw from direct engagement, we continue to monitor the system and ensure the right information and incentives are flowing, until we leave behind a more sustainable and growing system.

Conclusion

Market systems development programming addresses the underlying causes of the problems in a system and requires behavior change by the actors in that system. The key to coming up with the right strategy to drive change is clearly understanding the current situation: the core relationships, the supporting functions, and the rules in the market system, as well as the dynamics of what is changing and why. Once these factors are understood, it is possible to come up with a vision for the growth of the sector and a strategic approach for achieving it.

We must be conscious of the strengths, weaknesses, and characteristics of the market environment, and design our interventions accordingly. Our approach will vary based on the conditions in the market. Our role as facilitators will vary depending on the strength of the underlying market system, from a “heavy hand” to a “light touch”.

Most importantly, we need to design the interventions with exit in mind. We must be thinking about the desired end-state from day one. We must find the right partners—with the will to change and a value proposition strong enough to serve as the pilot for a mainstream intervention. We must be mindful of the actions needed to crowd in other market actors, largely through information sharing, and the (limited) support to help them engage. And above all, we must know when to get out.