DEVELOPMENTS

Mobile Services for the Unbanked: Finding a Viable Commercial Model

Sep 2, 2014

Providing mobile financial services to improve financial inclusion is an exciting proposition. Banks and non-banks alike see enormous promise in the ubiquitous mobile phone.

The problem is cost. And the cost problem on the provider side inevitably translates into an adoption problem on the consumer side, so the poor remain unbanked. Our challenge is to reduce the upfront costs of service for providers so they can in turn retail cheaper services. Shared services platforms could be part of the answer.

There are two essential components to any viable set of mobile financial services.

1. The mobile money infrastructure, which consists of technology and products suitably integrated with value chain partners such as banks, network operators, and merchant networks.

2. A network of financial services agents to bring the financial service to local consumers, typically operating through local shops such as grocery stores and chemists.

Let's take each of these components in turn.

The Infrastructure

When financial service providers think about mobile money infrastructure, they typically envisage two options: building the platform in-house, using their own information technology and product teams; or buying the platform and working with the vendor to customise it.

The business case for such mobile deployments factors in capital and operating costs, offset by anticipated revenue from the currently unbanked or under-banked—plus a certain amount of income derived by shifting low-revenue mass-market consumers to cheaper service channels (self-servicing if possible).

The first financial services provider launches its offering, followed by the second and the third, and so on. Each competitor relies on revenues generated from the same, low-revenue-generating customer base. Each must recover its investment in developing, hosting, and servicing the platform. This imperative keeps the cost high to those who can least afford it. In this extremely cost sensitive segment of the market, it is not too much of an oversimplification to say that the cost of a service is inversely proportional to its adoption.

But what if we could sidestep the 'build or buy' options? A shared services provider model may enable us to circumvent heavy up-front investment in multiple technology platforms and thereby lower the cost of the service to the end consumer.

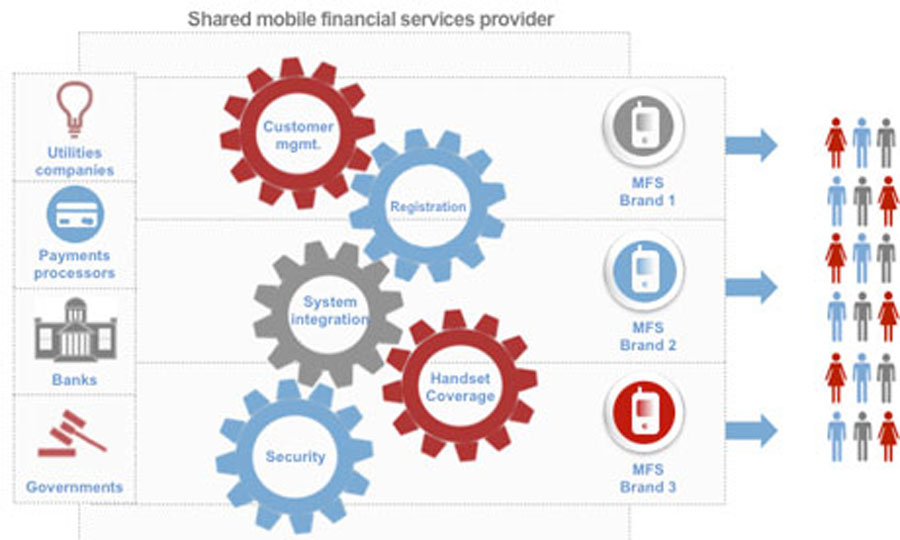

A shared mobile financial services platform is a service provided by a trusted, independent organisation that serves multiple financial service providers using standardised systems and processes. These financial service providers invest jointly and create a platform that can be shared among member organisations. The trusted provider ensures clear lines of division between each member's support services and technology platform to provide for competitive differentiation.

In this scenario, consumers should benefit from a range of low cost basic services offered by multiple providers on a common platform. Competition between providers would yield new services, presumably at a premium.

This approach is hardly novel. Visa, Mastercard, and other global payment companies provide common payment networks and rules of engagement on which numerous financial service providers build their products and value propositions.

Shared Agent Networks

Agent networks — points of presence close to the target consumers—are the backbone of any mobile financial service. They enable financial services providers to reach out to the consumer rather than asking the consumer to come to the provider's branch office.

In urban areas, it is comparatively easy to find suitable agents with sufficient resources, market awareness, and existing customers that might be converted into customers for financial services. But in peri-urban or rural areas, multiple service providers often end up using the same agent, much as the same shop will sell airtime from various mobile phone operators. Given his or her leverage in this market, the agent may negotiate different levels of commission from different financial service providers, which again raises costs for the service provider and hence for the consumer.

There is an opportunity here for a shared agent network to provide local, standardised agent services to financial institutions. While there are challenges to such an approach, such as ensuring that the agent is able to differentiate between the many different service providers' offerings, the end result should be to reduce the cost such institutions face in building out their own networks.

Plain Sailing

However, there are a number of potential barriers to the deployment of such a shared technology platform and distribution network:

- Financial institutions are not always willing to work together.

- They are also wary of the lack of perceived competitive advantage if more than one bank uses the same provider—"what is my differentiator?"

- Financial institutions are reluctant to make one service provider too powerful, or become beholden to that supplier over time.

- The 'not invented here' syndrome makes financial service providers' IT departments nervous.

- Regulators may be hesitant to mandate service to banks in a given country.

- Some countries may lack the fundamental infrastructure to host such a solution.

- If the platform is hosted internationally, regulators sensitive to data. protection and other issues may not be comfortable with customer data being housed outside the country.

Not surprisingly, some combination of these factors has made such platforms difficult to get off the ground, especially in emerging markets. But we should remember that a similar mindset prevailed among banks even in mature markets like the United Kingdom as late as the 1980s, when the sharing of ATMs became an issue. That issue was resolved with the formation of a shared services platform called Link Exchange (now part of VocaLink).

How To Move Forward

The overall commercial model of the shared services platform should be based on revenue share principles. In simple terms, the entity that benefits the most from a particular transaction will be charged for the service. For example, a consumer benefits substantially from remote bill pay services, and so does the biller through more robust and timely cash collections; so the consumer and/or the biller will be charged a commission for remote bill payments.

There are many moving parts to be coordinated in putting a shared services platform together:

- A robust and scalable technology platform.

- A service desk or technology support team that can manage a multi-tenant environment.

- A customer support team that can handle customer calls from different banks' clients.

- A product development team that can compartmentalise and deliver services for each financial service provider on the platform.

- Strict internal confidentiality at the management level.

- Clear operating procedures and processes.

- Funding to implement the platform and staff the support functions (and patient capital).

- Clearance from regulatory bodies to approve such a service.

If these things can be brought together, the business case is there to deliver margins for service providers, savings for consumers, and improving rates of financial inclusion for the poor.